Want more insights in your inbox?

Subscribe to our monthly newsletter.

Subscribe to our monthly newsletter.

PLATFORM

I need to...

I need to...

I need to...

FOR MEDIA OWNERS

TECHNOLOGY

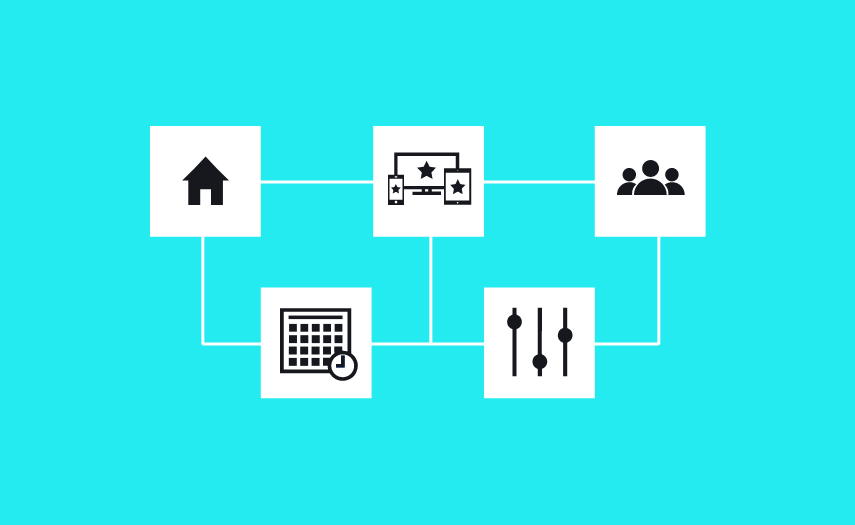

Aperture Viewer Graph gives you the power to target precise audiences and enable seamless household-level engagement across all screens and devices, leveraging first- and third-party data with deep audience insights. We ensure unparalleled connectivity – wherever your audience may be.

Totally agnostic inventory.

With our modular architecture, you can leverage as much or as little as you need. We’re open by design.

Thanks to our patented, cookieless technology, audience segments get onboarded and matched to the TV universe in minutes.

With 90+ cable networks, 200 MVPDs, and 1,100 broadcast stations, our partner roster ensures your messages appear alongside quality content.