Today, just 10% of one billion global pay TV homes are enabled for addressable advertising.

For EU broadcasters and operators, addressable growth represents a huge opportunity. By 2023, Strategy Analytics projects the global TV and digital video advertising market will total $260 billion. If 30% of that spend shifts to addressable advertising, as many advanced advertising experts predict, $90 billion in global advertising will be spent on addressable advertising. With their network and video delivery capabilities, as well as their direct-to-consumer relationships, platform operators can enable cross-platform, anonymized, deterministically targeted advertising with closed-loop attribution. They have the opportunity to get a significant piece of that advertising spend shift through revenue share arrangements with their content providers just as Youtube, Roku, Hulu and other video market entrants do today.

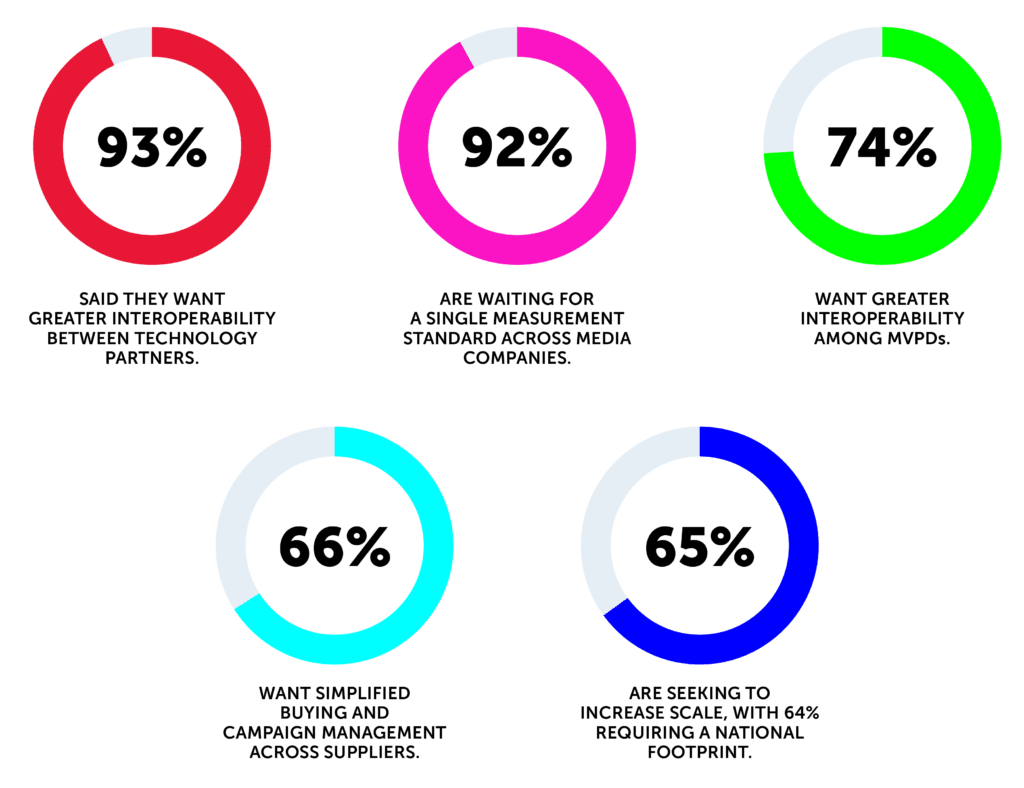

Competition for addressable dollars will be fierce, especially as digital companies with massive scale and deterministic targeting capabilities enter the market. To compete with digital players, platform operators have to achieve the necessary scale across data, content and advertising capabilities. And the way to do that is by partnering with broadcasters and enabling cross-screen advanced advertising, especially across linear television viewing which still garners the majority of time spent for most major TV and video markets. By not enabling targeted advertising on linear TV, the leading broadcasters and platform operators are not leveraging a core scale asset as they compete with digital video players.

A close partnership, like the integration between Liberty Global’s Virgin Media and Sky’s AdSmart platform, is a great example of an operator and broadcaster coming together for a joint addressable advertising initiative. Through an integration with Sky’s AdSmart platform, targeted addressable advertising is delivered across Virgin Media’s UK footprint, allowing partners and advertisers to utilize targeting capabilities that have previously been confined to digital advertising. Additionally, these capabilities will be enabled cross platform so advertisers can optimize reach and frequency across live and on-demand TV, whether viewed on through a STB or on digital devices.

In order to deploy this kind of system, an operator has to offer multiplatform TV advertising execution for content providers, starting with linear with television, where more than three quarters of all viewing is done live, according to BARB, as well as video-on-demand and video on devices. Reach and frequency control is needed across platforms and TV formats to ensure subscribers get personalized advertising but aren’t overexposed to the point where their experience is degraded.

An open system, one that can integrate with broadcasters’ advertising systems, is needed – this means the system must be API-driven and enables broadcasters to easily integrate with their existing ad systems for key functions like campaign integration, audience queries and robust reporting on performance and delivery.

In addition, there’s an opportunity to enable these types of advanced advertising services between operators, enabling even greater scale and automation and giving broadcasters the ability to manage campaigns across two different operator footprints in a single, unified workflow. Operators would also get a faster, more cost-effective way to generate revenue and achieve scale by pooling their data assets while sharing advanced advertising services managed in the cloud.

Bringing digital’s best, leaving behind the rest

A broadcaster-operator partnership can improve the relevance of subscriber experiences, and it can improve ROI for advertisers. The key is doing it in a privacy-complaint way.

Ad tech practices are under ever closer scrutiny with GDPR in full swing. Complaints filed in Belgium, Luxembourg, the Netherlands and Spain argue that real-time bidding, RTB, entails “wide-scale and systemic” breaches of Europe’s data protection regulations. A report from the UK Information Commissioner’s Office found systematic issues including “insufficient consent, transparency and overbroad collection of data within the RTB supply chain,” calling out complex, confusing privacy and data disclosures.

Consumer trust is at stake, and it’s more important than ever to leave behind what didn’t work with digital advertising. Fortunately, addressable TV advertising has privacy safeguards built into it. Virgin Media and Sky, for instance, have put in place automated addressable advertising workflows that avoid the data leakage associated with RTB and are more privacy compliant.

There are plenty more benefits of deploying an addressable TV solution for an operator beyond new revenue generation, including a better video experience and more efficient marketing of an operator’s own product and services offerings. With high quality data assets, operators can expand their traditional ARPU-based businesses with a stronger focus on data monetization. Today, with digital giants, data monetization happens mostly through enabling more effective advertising. By enabling addressable advertising services and leveraging their existing network and video delivery capabilities, as well as their direct-to-consumer relationships, operators can offer platform-based advanced advertising services that justify a healthy revenue share of advertising spend.

Now is the time for operators to take control of their own destiny and seize the addressable opportunity in the EU. Delivering household addressable advertising to subscribers will bring value to the entire ecosystem – broadcasters, content owners, and advertisers.

Learn more about our Content Monetization Solutions or get in touch.